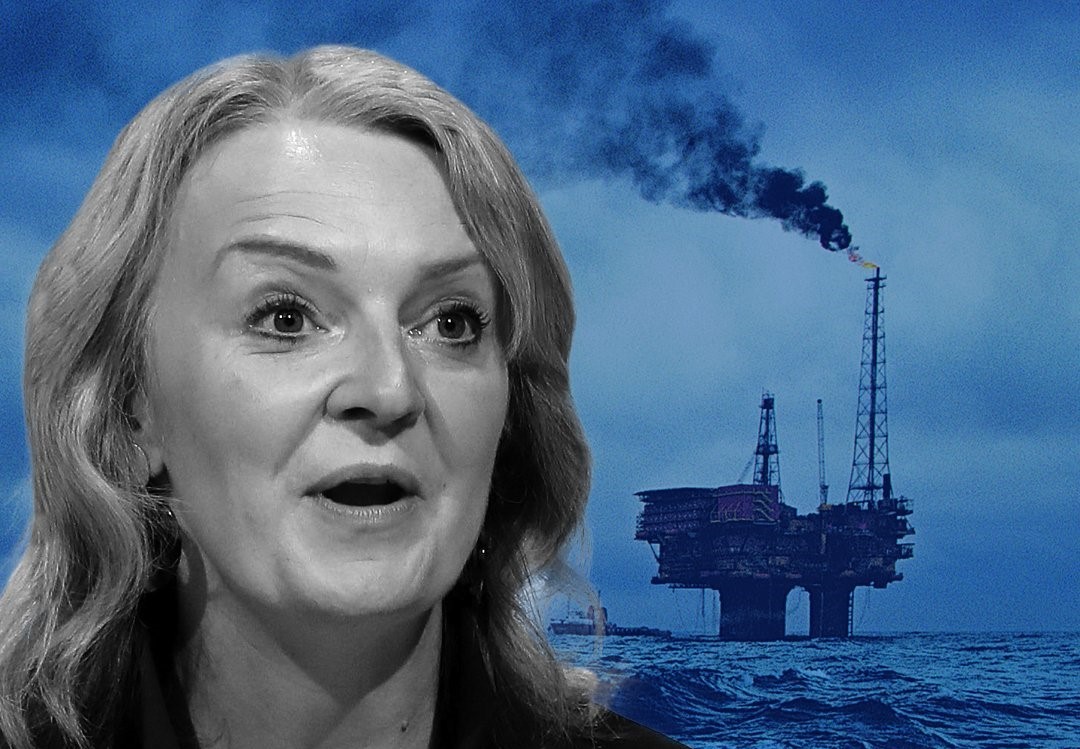

Former Shell worker Liz Truss has ruled out extending the windfall tax on energy companies’ £180 billion profits to help pay for her £130 billion plan to tackle soaring energy bills fuelling the UK’s cost of living crisis.

Instead, Truss will borrow the eye watering amount, with taxpayers having to pay back the debt – despite the new prime minister telling the Commons (in her first appearance at PMQs) that she prefers tax cuts to grow the economy.

While the long-awaited and even longer over-due plan won’t be announced by the new prime minister until tomorrow, the Telegraph confidently reports “energy bills will be frozen” until 2024, “the year the next general election is expected.”

But that’s not quite the case as the bills won’t actually be frozen until another 25% or so hike is added to energy bills first. Average household energy bills are currently capped at £1,971 a year. Truss wants to cap them at £2,500.

That 25% increase is obviously far better for households than the 80% rise taking average energy bills to £3,549 per year which would have come in October without government intervention.

But it is still an increase and one that will be felt and paid for long after the government’s one-off £400 payment to help with bills has been pocketed by the energy companies.

The Telegraph has swallowed the line, stating the “freeze” at £2,500 will end up “saving households more than £1,000.”

That saving is based on what was to come because the fact remains, the likely £2,500 cap will actually represent a 100% price increase on average household energy bills in little more than a six month period. The energy price cap was £1,277 on March 31 2021 – the day before it soared 54% to its current rate on April 1 (which, coincidentally, was the same day MPs received a £2,212 pay rise).

Labour has said it would freeze energy bills at their current rate – ie. without another 25% hike. And it would fund this through a proper windfall tax on energy company profits.

Truss: ‘Windfall tax would put off companies investing in UK’

Not so for Truss – who worked as an economist for Shell before becoming an MP.

Energy companies are basically printing money at this stage. It’s reported that combined they are making £170 billion in excessive profits.

Truss’s old firm Shell has been raking in around £1,200 per second in profit this year – enabling it to post quarterly profits of £9.4billion in July.

BP makes £880 profit every second (or £52,800 a minute, £3,168,000 every hour, or £76,032,000 pure profit every day).

It’s enough for BP to announce a £3.2billion windfall dividend payout for its shareholders. Enough for Shell to announce a £5bn share buyback and bumper bonuses for bosses.

But not enough for PM Truss to introduce a proper windfall tax – one without loopholes – unlike Sunak’s sham windfall tax.

Truss explained her reticence to tax energy giants’ profits during the leadership campaign, saying: “With a windfall tax, it might secure money in the short term but it puts off companies investing in Britain in the long term.”

She has even ruled out adding the cost of her plan over the next years to customers’ bills. That was “the leading proposal from the Treasury and energy firms”, according to the Guardian, but critics warned about the difficulty of justifying the extra charge on peoples’ bills when energy companies continue to make obscenely massive profits.

The optics would not be good for the former Shell economist, risking further her already precarious position in Number 10 (the result of the “brutal culling” of Rishi Sunak supporters from her new Cabinet). Better therefore to borrow the money and give it to the energy companies (and hide its real cost to the people who will have to pay for it by burying it in tax, and ever higher debt repayments).

The Conservatives made an awful lot about the handover note Labour left at the Treasury in 2010, saying there was no money left for David Cameron’s incoming coalition. It was used to justify a decade of Tory austerity. The consequences of the deep cuts in public spending are witnessed in the UK’s current unravelling with myriad crises everywhere.

When Labour left government in 2010 – in the fallout of 2008’s financial crash – government debt had jumped from 36% of GDP in 2007-8 to 65% in 2009-10, according to Full Fact.

At the end of March this year UK general government was equivalent to 99.6% of GDP at £2,365.4 billion, the Office for National Statistics states.

Truss’s plans to borrow to spend big – especially on energy and defence – while cutting taxes means the difference will all be piled to the debt, making the deficit – and interest repayments – even bigger. Simultaneously, cuts in some areas of public spending will have to be made, Truss will argue with those cuts likely to be the wage packets of nurses, teachers and other public sector workers.

And these will only end up adding even more strain to the UK’s already overstretched public institutions.

Clearly, the UK’s current dire situation – that the former energy giant economist is in charge of fixing – is far different to that being enjoyed by her ex-bosses at Shell.

While Shell makes £1,200 profit every second, the UK’s national debt grows five times as fast.