Rishi Sunak’s claims to be a tax-cutting Tory chancellor have been debunked by the Office for Budget Responsibility (OBR).

Sunak’s Spring Statement turned out to be a mini-budget and featured headline grabbing measures such as the 5p off fuel duty (for 12 months), a national insurance cut for 30 million workers and a pledge to cut income tax by 1p in 2024.

However, the OBR said Sunak’s tax-cuts will “offset” just a sixth of the tax increases introduced by the chancellor since he was appointed just two years ago as the tax burden reaches levels not seen since the 1940s.

‘Households facing significant squeeze in living standards’

Despite the chancellor’s assertion that he is “on the side” of hard hit families, his package has “nevertheless left households facing a significant squeeze in living standards,” according to the Financial Times.

The independent OBR expects the domestic energy price cap to surge past £2,800 in October with a record £830 increase in bills arriving just before winter sets in. This will come on top of April’s 54% increase when households will have to find the extra £690 to pay for their electricity and gas.

Wages for teachers, nurses and all other public sector workers are expected to lag way behind inflation, leaving millions worse off. Inflation is forecast by the OBR to reach 7.2% this year – its highest rate since 1991 – while quarterly inflation will reach around 9% in October to December. That will be the highest rate since the early 1980s.

However, inflation has delivered unexpected billions to the Treasury. Higher prices means more VAT and duty receipts while Sunak’s earlier decision to freeze income tax thresholds has lifted millions more workers into higher tax bands. The additional tax receipts are worth £15 billion. Sunak’s pot has also been filled with £5bn from increased student loan repayments.

Sunak’s tax-cutting is a sixth of his tax raising, says OBR

Sunak was under pressure from Conservative MPs to scrap April’s national insurance hike with the cost of living crisis deepening daily. Instead Sunak gave them what he called the “biggest single personal tax cut in a decade” – effectively a £330 tax cut for around 70% of workers – by raising the threshold for national insurance contributions from £9,568 to £12,570.

Sunak said this will cost the Treasury £6 billion from July and he confirmed April’s 1.25% national insurance rise for both workers and employers will go ahead in April.

While Sunak claims to be a tax cutting Tory chancellor – his pledge to cut income tax from 20% to 19% in 2024 on top of the national insurance and fuel duty cut – the OBR’s conclusion, based on the facts, is very different.

“Net tax cuts announced in this Spring Statement offset around a sixth of the net tax rises introduced by this chancellor,” according to the OBR.

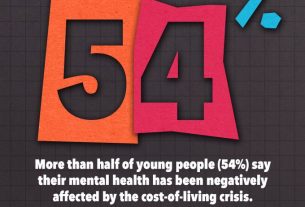

The UK’s tax burden is set to be at its highest since the late 1940s. Alarmingly, the country is also heading for the biggest fall in living standards since ONS records began in 1956-57, with household disposable incomes per person dropping 2.2% next year.